Q.12. Following is the Balance Sheet of Jain, Gupta and Malik as on March 31, 2016.

| Liabilities | Amount (Rs.) | Assets | Amount (Rs.) |

| Sundry Creditors | 19,800 | Land and Building | 26,000 |

| Telephone Bills Outstanding | 300 | Bonds | 14,370 |

| Accounts Payable | 8,950 | Cash | 5,500 |

| Accumulated Profits | 16,750 | Bills Receivable | 23,450 |

| Sundry Debtors | 26,700 | ||

| Capitals : | Stock | 18,100 | |

| Jain 40,000 | Office Furniture | 18,250 | |

| Gupta 60,000 | Plants and Machinery | 20,230 | |

| Malik 20,000 | 1,20,000 | Computers | 13,200 |

| 1,65,800 | 1,65,800 |

The partners have been sharing profits in the ratio of 5:3:2. Malik decides to retire from business on April 1, 2016 and his share in the business is to be calculated as per the following terms of revaluation of assets and liabilities : Stock, Rs 20,000; Office furniture, Rs 14,250; Plant and Machinery Rs 23,530; Land and Building Rs 20,000.

A provision of Rs 1,700 to be created for doubtful debts. The goodwill of the firm is valued at Rs 9,000.

The continuing partners agreed to pay Rs 16,500 as cash on retirement of Malik, to be contributed by continuing partners in the ratio of 3:2. The balance in the capital account of Malik will be treated as loan.

Prepare Revaluation account, capital accounts, and Balance Sheet of the reconstituted firm.

In the books of Jain and Gupta

Revaluation Account

Dr. Cr.

| Particulars | Amount (Rs.) | Particulars | Amount (Rs.) | |

| To Office Furniture | 4,000 | By Stock | 1,900 | |

| To Land and Building | 6,000 | By Plant and Machinery | 3,300 | |

| To Provision for Doubtful Debts | 1,700 | By Loss transferred to: | ||

| Jain’s Capital A/c | 3,250 | |||

| Gupta’s Capital A/c | 1,950 | |||

| Malik’s Capital A/c | 1,300 | 6,500 | ||

| 11,700 | 11,700 | |||

Partners’ Capital Account

Dr. Cr.

| Particulars | Jain | Gupta | Malik | Particulars | Jain | Gupta | Malik |

| To Revaluation (Loss) | 3,250 | 1,950 | 1,300 | By Balance b/d | 40,000 | 60,000 | 20,000 |

| To Malik’s Capital | 1,125 | 675 | – | By Accumulated Profits | 8,375 | 5,025 | 3,350 |

| To Cash | – | – | 16,500 | By Jain’s Capital A/c | – | – | 1,125 |

| To Malik’s Loan | – | – | 7,350 | By Gupta’s Capital A/c | – | – | 675 |

| To Balance c/d | 53,900 | 69,000 | – | By Cash | 9,900 | 6,600 | – |

| 58,275 | 71,625 | 25,150 | 58,275 | 71,625 | 25,150 | ||

Balance Sheet

| Liabilities | Amount (Rs.) | Assets | Amount (Rs.) |

| To Sundry Creditors | 19,800 | By Stock | 20,000 |

| To Telephone Bills Outstanding | 300 | By Bonds | 14,370 |

| To Accounts Payable | 8,950 | By Cash | 5,500 |

| To Malik’s Loan | 7,350 | By Bills Receivable | 23,450 |

| By Sundry Debtors | 26,700 | ||

| To Partners’ Capital: | Less: Provision for Bad Debts 1,700 | 25,000 | |

| Jain 53,900 | By Land and Building | 20,000 | |

| Gupta 69,000 | 1,22,900 | By Office Furniture | 14,250 |

| By Plant and Machinery | 23,530 | ||

| By Computers | 13,200 | ||

| 1,59,300 | 1,59,300 | ||

Working Note:

1) Malik’s share of goodwill = Total Goodwill × Retiring Partner Share

= 9,000 x 2/10

= Rs. 1,800

2) Gaining Ratio = New Ratio – Old Ratio

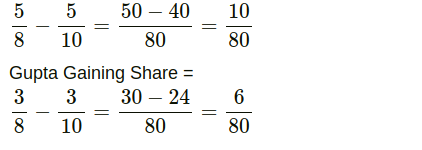

Jain’s Gaining Share = 5/8-5/10

Gaining Ratio between Jain and Gupta = 10:6 or 5:3

0 Comments