Q.5. Digvijay, Brijesh and Parakaram were partners in a firm sharing profits in the ratio of 2:2:1. Their Balance Sheet as on March 31, 2017 was as follows:

| Liabilities | Amount (Rs.) | Assets | Amount (Rs.) |

| Creditors | 49,000 | Cash | 8,000 |

| Reserves | 18,500 | Debtors | 19,000 |

| Digvijay’s Capital | 82,000 | Stock | 42,000 |

| Brijesh’s Capital | 60,000 | Buildings | 207,000 |

| Parakaram’s Capital | 75,500 | Patents | 9,000 |

| 2,85,000 | 2,85,000 |

Brijesh retired on March 31, 2017 on the following terms:

(i) Goodwill of the firm was valued at Rs 70,000 and was not to appear in the books.

(ii) Bad debts amounting to Rs 2,000 were to be written off.

(iii) Patents were considered as valueless.

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of Digvijay and Parakaram after Brijesh’s retirement.

Revaluation Account

| Particulars | Amount (Rs.) | Particulars | Amount (Rs.) |

| To Bad debts | 2,000 | By Loss transferred to partners capital A/c | |

| To Patents | 9,000 | Digvijay | 4,400 |

| Parakaram | 4,400 | ||

| Brijesh | 2,200 | ||

| 11,000 | 11,000 | ||

Partners capital A/c

| Particulars | Digvijay | Brijesh | Parakaram | Particulars | Digvijay | Brijesh | Parakaram |

| To Brijesh’s capital A/c | 18,667 | _ | 9,333 | By balance b/d | 82,000 | 60,000 | 75,500 |

| To Revaluation A/c (loss) | 4,400 | 4,400 | 2,200 | By reserve | 7,400 | 7,400 | 3,700 |

| To Brijesh’s Capital A/c | _ | 91,000 | _ | By Digvijay’s capital A/c | _ | 18,667 | _ |

| By balance c/d | 66,333 | _ | 67,667 | By Parakaram’s capital A/c | _ | 9,333 | _ |

| 89,400 | 95,400 | 79,200 | 89,400 | 95,400 | 79,200 | ||

Balance sheet

as on March 31,2017

| Liabilities | Amount (Rs.) | Assets | Amount (Rs.) | |

| To Creditors | 49,000 | By cash | 8,000 | |

| To Brijesh’s Loan A/c | 91,000 | By Debtors | 19,000 | |

| To Digvijay’s Capital A/c | 66,333 | Less: Bad debts | 2,000 | 17,000 |

| To Parakaram’s Capital A/c | 67,667 | By Stock | 42,000 | |

| By Buildings | 2,07,000 | |||

| 2,74,000 | 2,74,000 | |||

WN1.

Calculation for Brijesh’s goodwill distribution

= Firm’s Goodwill X 2/5

= 70,000 X 2/5

=Rs 28,000

WN2.

Calculation of Gaing ratio = New ratio – Old ratio

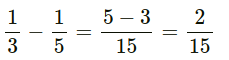

Digvijay =

Parakaram =

Gaing Ratio is 2:4

0 تعليقات